Morgan Stanley analyst Adam Jonas has reinstated Tesla (TSLA) as a top pick, projecting its shares could reach $430, driven by the company's expansion into artificial intelligence (AI) and robotics. Despite a tumultuous February, where Tesla's stock fell nearly 28% due to declining EV sales and concerns about CEO Elon Musk’s political involvement, Jonas sees this as an "attractive entry point" for investors.

On March 3, 2025, Tesla shares dipped over 2.8% amidst a broader tech sell-off, even after initially rising 2% following Jonas's optimistic report. He noted that Tesla's expected decline in year-over-year deliveries for 2025 reflects the company's shift from a purely automotive focus to becoming a significant player in AI and robotics.

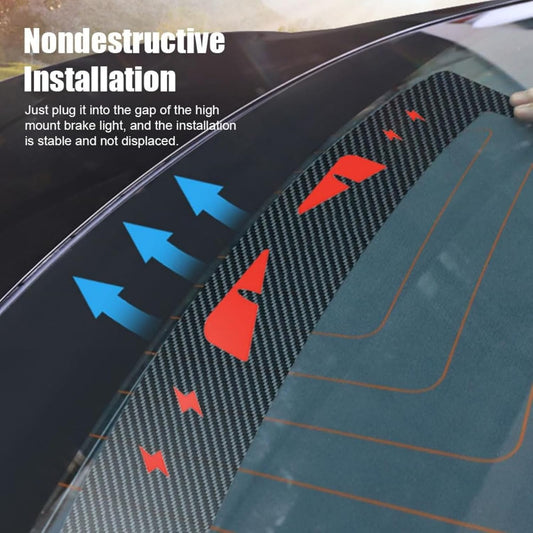

Stay up to date with the Tesla latest news on topabyte.com! Take 10% OFF to upgrade your Tesla in 2025 - Apply Code 'WELCOME10' Storewide

Jonas emphasized that the commercial potential of AI applications outside automotive sectors is rapidly growing, potentially surpassing that of autonomous driving. Tesla’s stock has struggled recently, diminishing much of its prior gains after hitting a peak of $479.86 in December.

Protests and backlash against Musk's political actions have further complicated the narrative, with many potential customers expressing disapproval. Tesla’s quarterly results are anticipated on April 22, as the market keeps a close eye on its performance amidst increasing competition and evolving business strategies.

Source: finance.yahoo

Explore more Accessories for your Model 3YSX & Cybertruck!

Use code "WELCOME10" to save 10% off discount:

https://topabyte.com/collections/accessories-model-3-2017-2023-2024-highland

https://topabyte.com/collections/accessory-fit-model-y

https://topabyte.com/collections/accessories-fit-cybertruck

https://topabyte.com/collections/ev-parts-fit-all-vehicles (Fit all cars)

Tesla stock, Morgan Stanley, Adam Jonas, $430 price target, AI, robotics, Elon Musk, EV sales decline, March 2025