Third Point, the hedge fund managed by Daniel Loeb, has made significant adjustments to its U.S. technology stock holdings in the first quarter of 2025. Notably, the fund completely divested from Tesla and Meta Platforms Inc., selling off all shares of these two companies. The move was driven by a strategic shift to reduce exposure to these high-profile tech giants amid concerns about market saturation and regulatory risks. Additionally, Third Point reduced its position in Amazon by selling over one million shares, bringing its total Amazon holdings to approximately 2.35 million shares. Despite these reductions, the fund increased its stake in Nvidia, the leading AI chip manufacturer, signaling confidence in the company's growth prospects in artificial intelligence and data center markets.

Stay up to date with the Tesla latest news on topabyte.com! Take 15% OFF to upgrade your Tesla in 2025 - Apply Code 'BLOG15' Storewide

In contrast to the reductions in electric vehicle and social media giants, Third Point expanded its investments in traditional and emerging sectors. The hedge fund increased holdings in companies such as Apollo Global Management, Pacific Steel, U.S. Steel, and AT&T, reflecting a diversified approach toward industrial and telecom sectors. According to recent filings, the top five holdings in Third Point's portfolio now include Pacific Steel, Amazon, Taiwan Semiconductor Manufacturing Company (TSMC) ADR, Live Nation, and Telephone & Data Systems. These adjustments highlight the fund's strategic pivot toward sectors with strong fundamentals and growth potential, especially in AI and industrial infrastructure.

The move to offload Tesla and Meta coincides with broader market concerns over regulation and valuation multiples in the tech sector. Meanwhile, Nvidia's stock has surged, benefiting from increased demand for AI hardware solutions, which has encouraged Third Point to boost its position in the company. The portfolio rebalancing reflects a nuanced view of the tech landscape in 2025, emphasizing AI growth and traditional industry resilience while reducing exposure to companies facing regulatory hurdles or overvaluation. This approach aims to optimize returns amid evolving market dynamics and technological advancements.

Source: sina

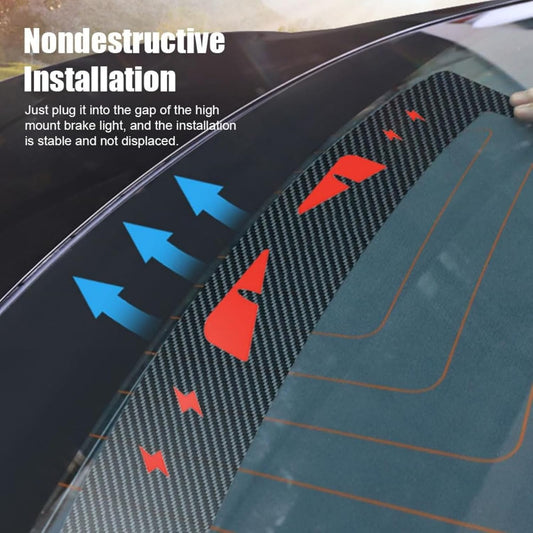

Explore more Accessories for your Model 3YSX & Cybertruck!

Use code "BLOG15" to save 15% off discount:

https://topabyte.com/collections/accessory-for-model-y-juniper-2025

https://topabyte.com/collections/accessory-fit-model-y

https://topabyte.com/collections/model-3-2024-2025-highland-accessory

https://topabyte.com/collections/accessories-model-3-2017-2023

Best Seller: https://topabyte.com/collections/all?page=1&sort_by=best-selling

Customize & Upgrade: https://topabyte.com/collections/model-3-y-s-x-cybertruck-customize-upgraded-accessories?sort_by=best-selling