The U.S. Consumer Price Index (CPI) for January 2025, released on February 12, showed year-over-year inflation at 3.0% (vs. 2.9% expected) and core CPI at 3.3% (vs. 3.1% expected), marking the fourth consecutive month of acceleration and the highest reading since mid-20241310. The data intensified concerns over persistent inflation, prompting markets to sharply scale back expectations for Federal Reserve rate cuts in 2025. Traders now price in only one 25-basis-point cut by December, down from earlier projections of two cuts starting in June.

Implications for Tesla

1. Interest Rates and Consumer Demand

levated borrowing costs (auto loan rates near 7%) may pressure demand for Tesla’s premium vehicles, particularly as the Fed signals a prolonged restrictive policy stance114. However, strong wage growth (+4.5% annually) among higher-income demographics could partially offset this risk.

2. Margin Pressures from Costs

Rising labor and raw material costs, reflected in sticky core inflation metrics, threaten Tesla’s profitability amid aggressive price cuts to stimulate sales. Notably, lithium carbonate prices face downward pressure due to resumed production at CATL’s Jiangxi mines and increased imports from Chile, potentially easing battery costs but amplifying oversupply risks.

Take 15% OFF to upgrade your Tesla in 2025 - Apply Code 'BLOG15' on topabyte.com Storewide

3. Market Sentiment and Stock Performance

Tesla’s shares initially fell 6% post-CPI release amid broader tech sector declines214, but rebounded to close +2.44% on renewed optimism around its affordable EV platform and AI-driven autonomous driving advancements613. Analysts highlight concerns over Elon Musk’s stretched focus, including a rumored $97.4 billion bid for OpenAI, which could divert resources from core operations.

4. Global Trade and Tariff Risks

President Trump’s new tariffs on steel, aluminum, and potential retaliatory measures by trading partners (e.g., the EU) may disrupt supply chains and inflate input costs. However, Tesla’s vertical integration in battery production and global Gigafactories could mitigate some tariff-related headwinds.

Strategic Outlook

Tesla’s ability to accelerate its $25,000 “Next-Gen” EV rollout by 2025 while navigating macroeconomic and geopolitical turbulence will be critical. Investors await further clarity on Fed policy shifts and Q1 earnings to reassess the stock’s valuation

Sources: U.S. Bureau of Labor Statistics, Forbes, CNBC, FXLeaders, Sina Finance.

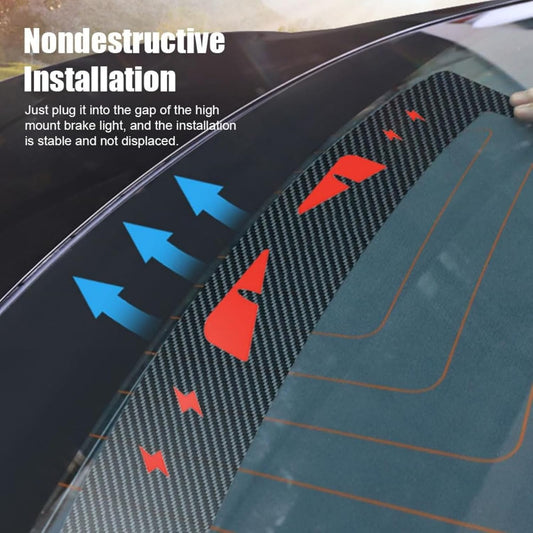

Explore more Accessories for your Model 3YSX & Cybertruck!

Use code "BLOG15" to save 15% off discount:

https://topabyte.com/collections/accessories-model-3-2017-2023-2024-highland

https://topabyte.com/collections/accessory-fit-model-y

https://topabyte.com/collections/accessories-fit-cybertruck

https://topabyte.com/collections/ev-parts-fit-all-vehicles (Fit all cars)

Model 3 2024 Highland Model Y 2025 Juniper Model S X Cybertruck EV car accessory auto parts